All Categories

Featured

Table of Contents

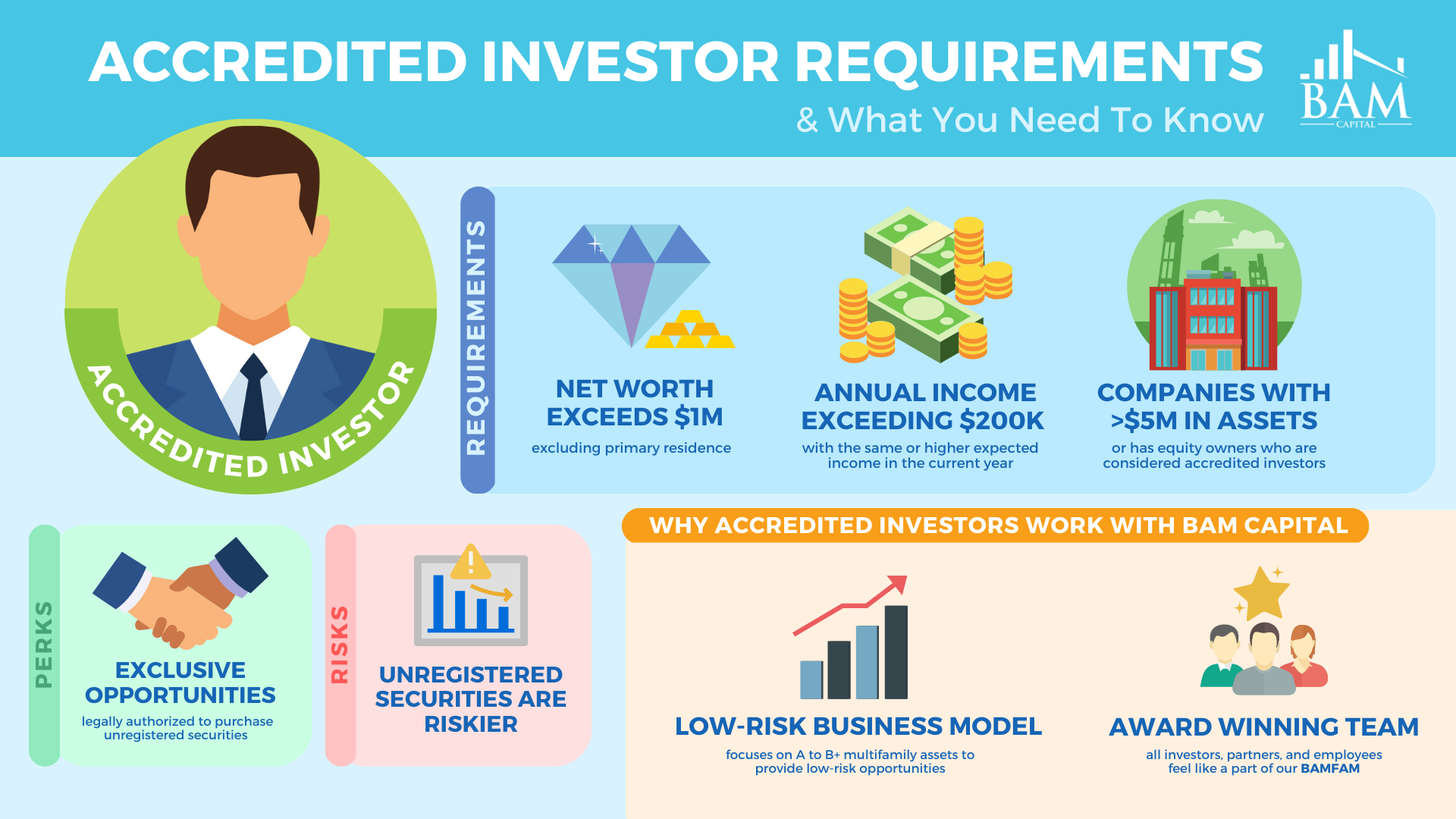

The SEC controls the policies for buying and offering safeties consisting of when and just how safety and securities or offerings should be registered with the SEC and what types of capitalists can take part in a particular offering - alternative investments for accredited investors. As an on-line commercial property investing industry, every one of our investment possibilities are readily available just to recognized financiers

Simply put, you're a certified investor if: OR ORYou are an owner in great standing of the Collection 7, Collection 65, or Series 82 licenses A certified investor doesn't have to be a specific person; trusts, certain pension, and LLCs may likewise qualify for certified investor condition. Each spending capability might have a little various criteria to be thought about accredited, and this flowchart describes the accreditation criteria for all entity types.

Within the 'accreditation confirmation' tab of your, you will be given the adhering to options. Upload financials and documents to show proof of your accredited condition based upon the demands summarized above. testifying to your status as a certified financier. The uploaded letter must: Be authorized and dated by a qualified third-party; AND Explicitly specify the providers credentials (ex lover, "I am a signed up certified public accountant in the State of [], certificate #"); AND clearly state that the investor/entity is an accredited investor (as specified by Guideline 501a).

Value Accredited Property Investment

Please note that third-party letters are only valid for 90 days from date of issuance. Per SEC Regulation 230.506(c)( 2 )(C), prior to approving a capitalist into an offering, sponsors have to obtain written evidence of an investor's accreditation status from a certified third-party. If a third-party letter is given, this will be passed to the enroller straight and has to be dated within the previous 90 days.

After a year, we will require upgraded economic papers for review. To find out more on accredited investing, visit our Accreditation Summary Short articles in our Help.

The examination is anticipated to be readily available sometime in mid to late 2024. The Level playing field for All Investors Act has actually already taken a significant step by passing your house of Representatives with an overwhelming ballot of assistance (383-18). investment opportunities for accredited investors. The following stage in the legislative procedure includes the Act being examined and voted upon in the Senate

Leading Real Estate Investing For Accredited Investors Near Me – Tampa 33601 FL

Provided the speed that it is moving currently, this can be in the coming months. While precise timelines doubt, given the significant bipartisan support behind this Act, it is anticipated to proceed with the legislative procedure with relative speed. Presuming the one-year home window is offered and attained, means the message would certainly be available sometime in mid to late 2024.

For the ordinary investor, the economic landscape can often really feel like a complicated labyrinth with minimal accessibility to certain financial investment opportunities. The majority of financiers don't certify for accredited investor status due to high income degree requirements.

Comprehensive Secure Investments For Accredited Investors Near Me (Tampa 33601 FL)

Join us as we debunk the globe of certified financiers, unwinding the meaning, needs, and potential benefits related to this designation. Whether you're new to spending or looking for to increase your economic horizons, we'll clarify what it implies to be an accredited capitalist. While organizations and banks can get certified investments, for the functions of this post, we'll be discussing what it indicates to be a certified capitalist as a person.

Personal equity is additionally an illiquid possession course that looks for long-lasting admiration away from public markets. 3 Exclusive placements are sales of equity or debt placements to professional financiers and organizations. This type of investment commonly acts as an alternative to other approaches that may be required to raise resources.

7,8 There are numerous disadvantages when considering a financial investment as a recognized investor. Start-up services have high failing prices. While they might show up to offer significant capacity, you may not redeem your first financial investment if you take part. 2 The investment cars supplied to certified financiers often have high investment requirements.

An efficiency cost is paid based on returns on a financial investment and can vary as high as 15% to 20%. 9 Numerous recognized investment automobiles aren't quickly made liquid should the need emerge.

Quality Accredited Investor Real Estate Deals

Please consult lawful or tax experts for particular information regarding your specific situation. This material was established and produced by FMG Collection to provide information on a topic that might be of passion.

The viewpoints expressed and worldly offered are for basic information, and should not be taken into consideration a solicitation for the acquisition or sale of any safety and security. Copyright FMG Suite.

Certified investors consist of high-net-worth individuals, banks, insurance provider, brokers, and trust funds. Accredited financiers are specified by the SEC as qualified to buy facility or advanced sorts of safeties that are not carefully controlled. Certain criteria should be met, such as having a typical yearly income over $200,000 ($300,000 with a partner or cohabitant) or working in the monetary sector.

Non listed safety and securities are inherently riskier due to the fact that they lack the normal disclosure needs that come with SEC enrollment., and various bargains including complex and higher-risk investments and instruments. A firm that is seeking to increase a round of financing might make a decision to straight come close to accredited capitalists.

Client-Focused Accredited Investor Real Estate Deals (Tampa)

It is not a public business yet wants to introduce a going public (IPO) in the future. Such a firm may choose to provide safety and securities to certified capitalists directly. This sort of share offering is referred to as a personal placement. For approved capitalists, there is a high capacity for risk or benefit.

The regulations for recognized investors vary among territories. In the U.S, the meaning of an approved investor is presented by the SEC in Regulation 501 of Guideline D. To be an accredited capitalist, a person must have a yearly income surpassing $200,000 ($300,000 for joint income) for the last two years with the expectation of making the exact same or a greater income in the current year.

An approved investor should have a internet well worth going beyond $1 million, either separately or collectively with a partner. This quantity can not include a key home. The SEC also thinks about applicants to be recognized investors if they are basic companions, executive officers, or directors of a business that is releasing non listed securities.

If an entity consists of equity proprietors that are accredited financiers, the entity itself is a certified investor. Nonetheless, an organization can not be formed with the single purpose of buying particular safety and securities. A person can certify as an approved financier by demonstrating enough education and learning or job experience in the monetary industry.

Latest Posts

How To Buy Property With Delinquent Taxes

Homes In Tax Foreclosure

Tax Lien Investing